- Joined

- Jul 5, 2021

- Messages

- 322

- Thread Author

- #1

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Belmont Financial Group LLC

Represented by Prodigium Law Firm

Plaintiff

v.

_Zeos

Defendant

COMPLAINT

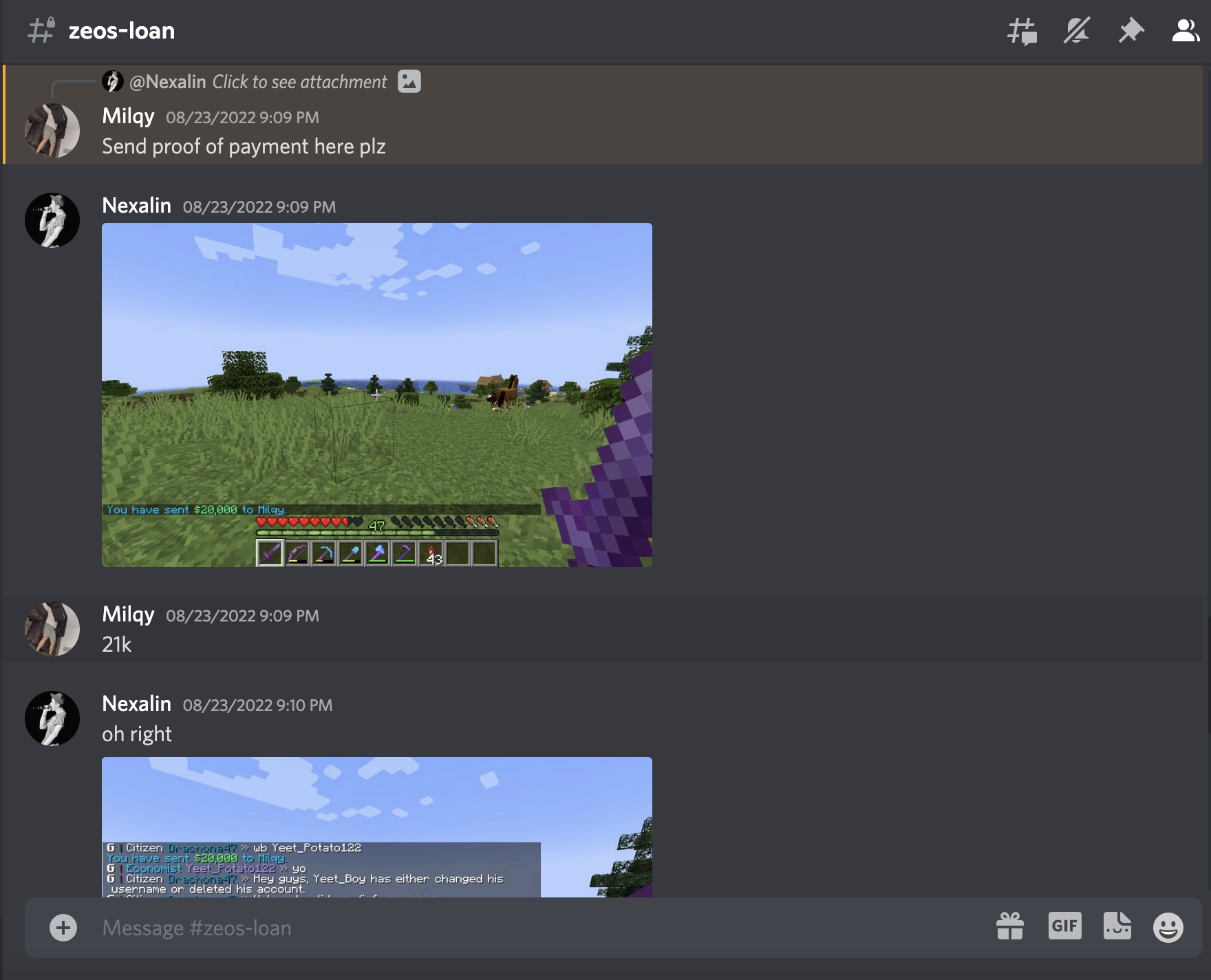

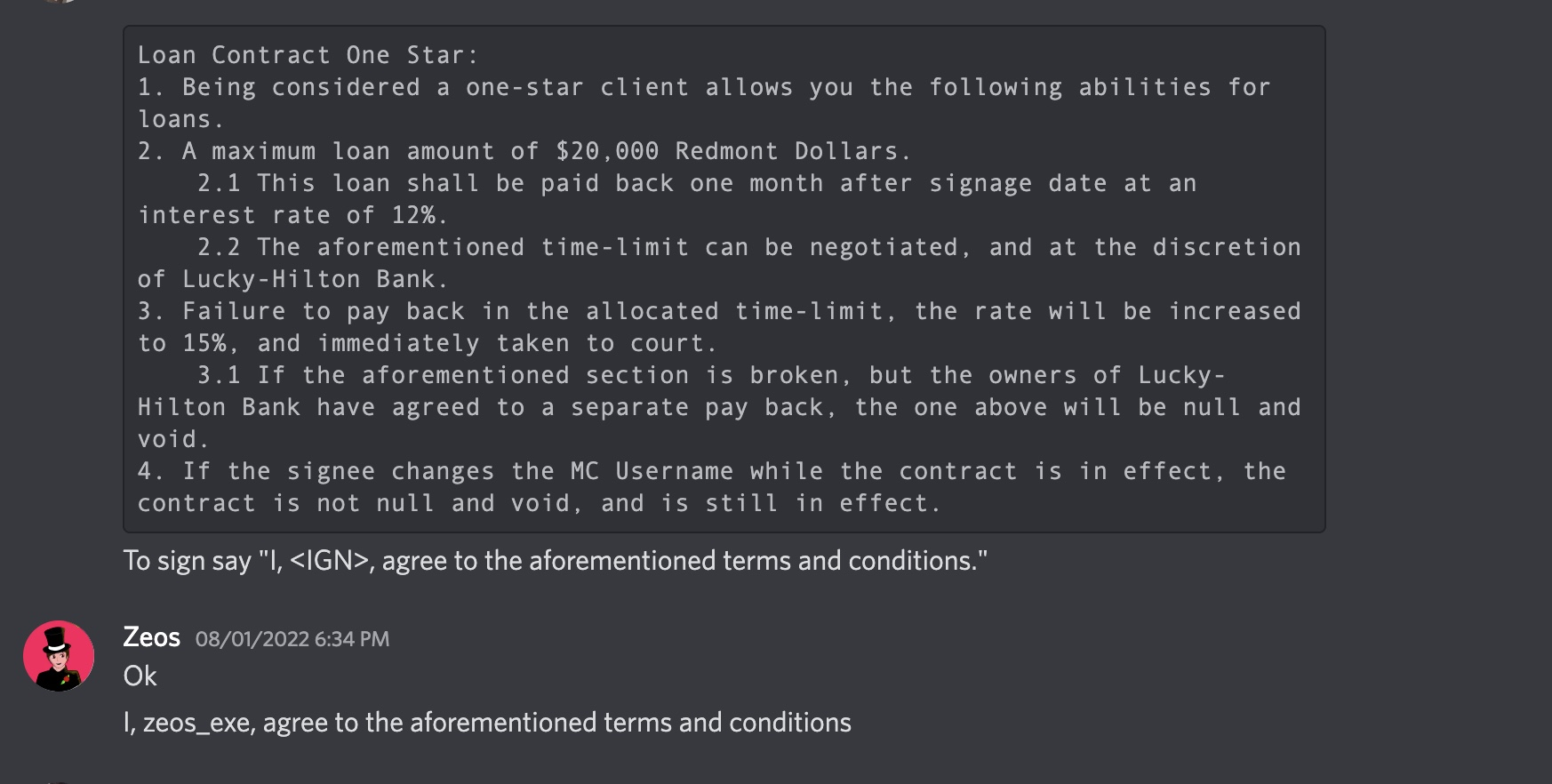

The Plaintiff complains against the Defendant as follows: In August 2022, the defendant took out a loan of $20,000 from LHBank. This loan was later sold by LHBank to Belmont Financial. The defendant was meant to pay the loan within a month with 12% interest. However, due to defendant's failure to pay on time, the contract stipulates the interest rate is increased to 15%. Therefore, we are seeking $20k in principal repayment and $3k in interest repayment, for a total of $23,000.

I. PARTIES

1. Belmont Financial Group LLC

2. LHBank

3. _Zeos

II. FACTS

1. On August 1, 2022, LHBank issued a loan to zeos_exe, with a 1 month timeframe.

2. On August 8, 2022, zeos_exe changed his in-game username to _Zeos.

3. On August 23, 2022, LHBank sold the loan to Belmont Financial.

4. The loan was due September 1, 2022, and we are far past that point.

III. CLAIMS FOR RELIEF

1. Defendant has violated their contract that was signed August 1, 2022.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $20,000 in loan principal repayment

2. $3,000 in loan interest repayment

3. $1,000 in legal fees

Proof of defendant username change: https://namemc.com/search?q=_Zeos

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: 11/19/2022

CIVIL ACTION

Belmont Financial Group LLC

Represented by Prodigium Law Firm

Plaintiff

v.

_Zeos

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows: In August 2022, the defendant took out a loan of $20,000 from LHBank. This loan was later sold by LHBank to Belmont Financial. The defendant was meant to pay the loan within a month with 12% interest. However, due to defendant's failure to pay on time, the contract stipulates the interest rate is increased to 15%. Therefore, we are seeking $20k in principal repayment and $3k in interest repayment, for a total of $23,000.

I. PARTIES

1. Belmont Financial Group LLC

2. LHBank

3. _Zeos

II. FACTS

1. On August 1, 2022, LHBank issued a loan to zeos_exe, with a 1 month timeframe.

2. On August 8, 2022, zeos_exe changed his in-game username to _Zeos.

3. On August 23, 2022, LHBank sold the loan to Belmont Financial.

4. The loan was due September 1, 2022, and we are far past that point.

III. CLAIMS FOR RELIEF

1. Defendant has violated their contract that was signed August 1, 2022.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $20,000 in loan principal repayment

2. $3,000 in loan interest repayment

3. $1,000 in legal fees

Proof of defendant username change: https://namemc.com/search?q=_Zeos

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: 11/19/2022