- Joined

- Oct 2, 2021

- Messages

- 173

- Thread Author

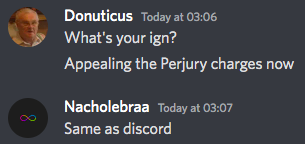

- #1

IN THE SUPREME COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Admin23

Plaintiff

v.

The Exchange

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

WRITTEN STATEMENT FROM THE PLAINTIFF

First, the Exchange has blatantly disregarded the Corporate Law and Shareholder Protections Act while supposedly doing their utmost job to uphold it. The Exchange has forced its customers to use a Discord bot that does not allow for custom prices and makes its own price based on something that is most definitely not supply and demand. Second, the Exchange has committed fraud twice by stating that it is illegal to allow for supply and demand to dictate prices (supply being the seller and demand being the buyer) and harmed the Plaintiff, Admin23, by doing so. Third, the Exchange has added insult to injury, quite literally and insulted and belittled the Plaintiff while violating the law.

I. PARTIES

1. Admin23 - Plaintiff

2. Someone (username in DC Discord is Aezal) - Employee of the Defendant

3. Nacholebraa - Owner of, and responsible party for, the Defendant

4. The Exchange - Defendant

II. FACTS

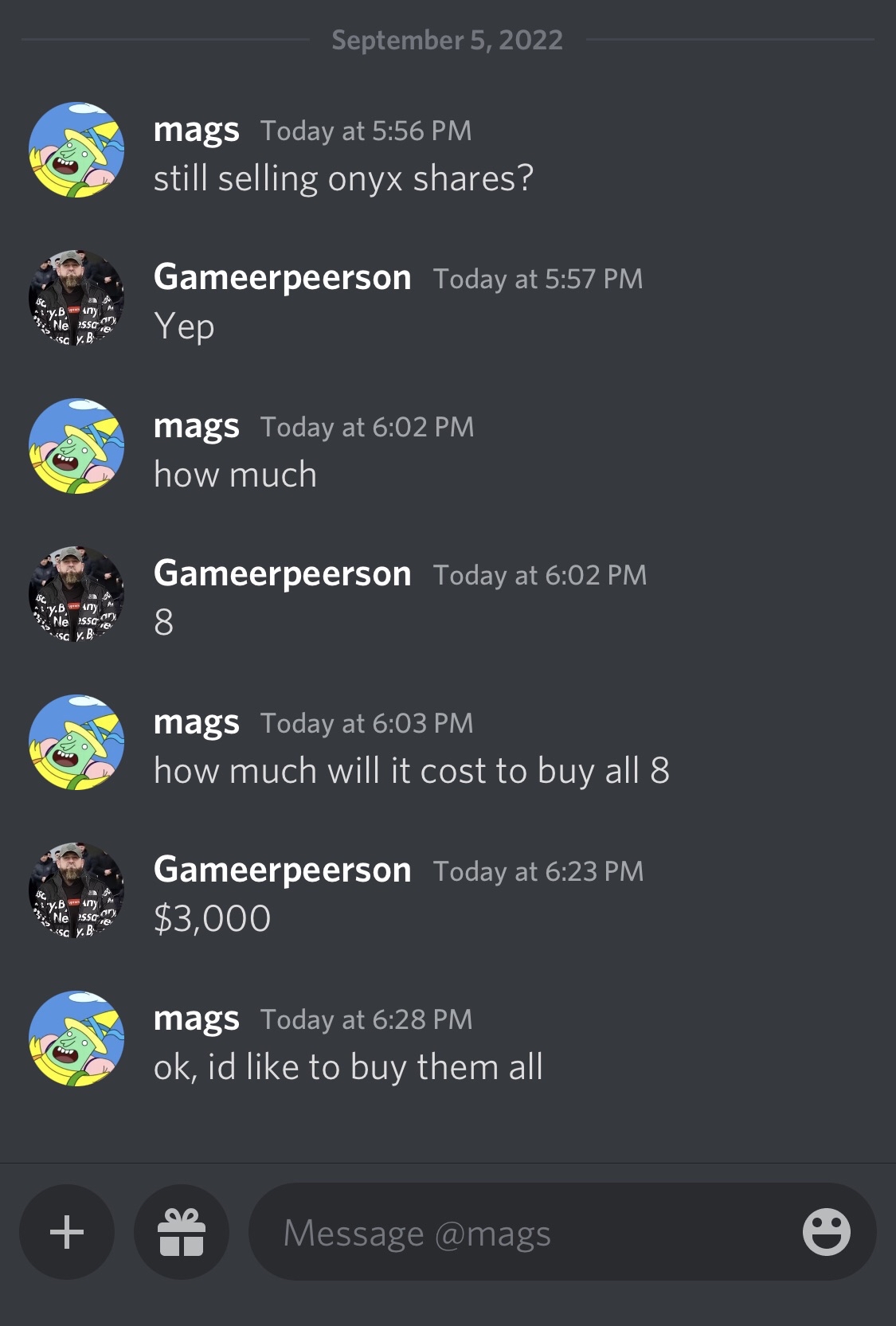

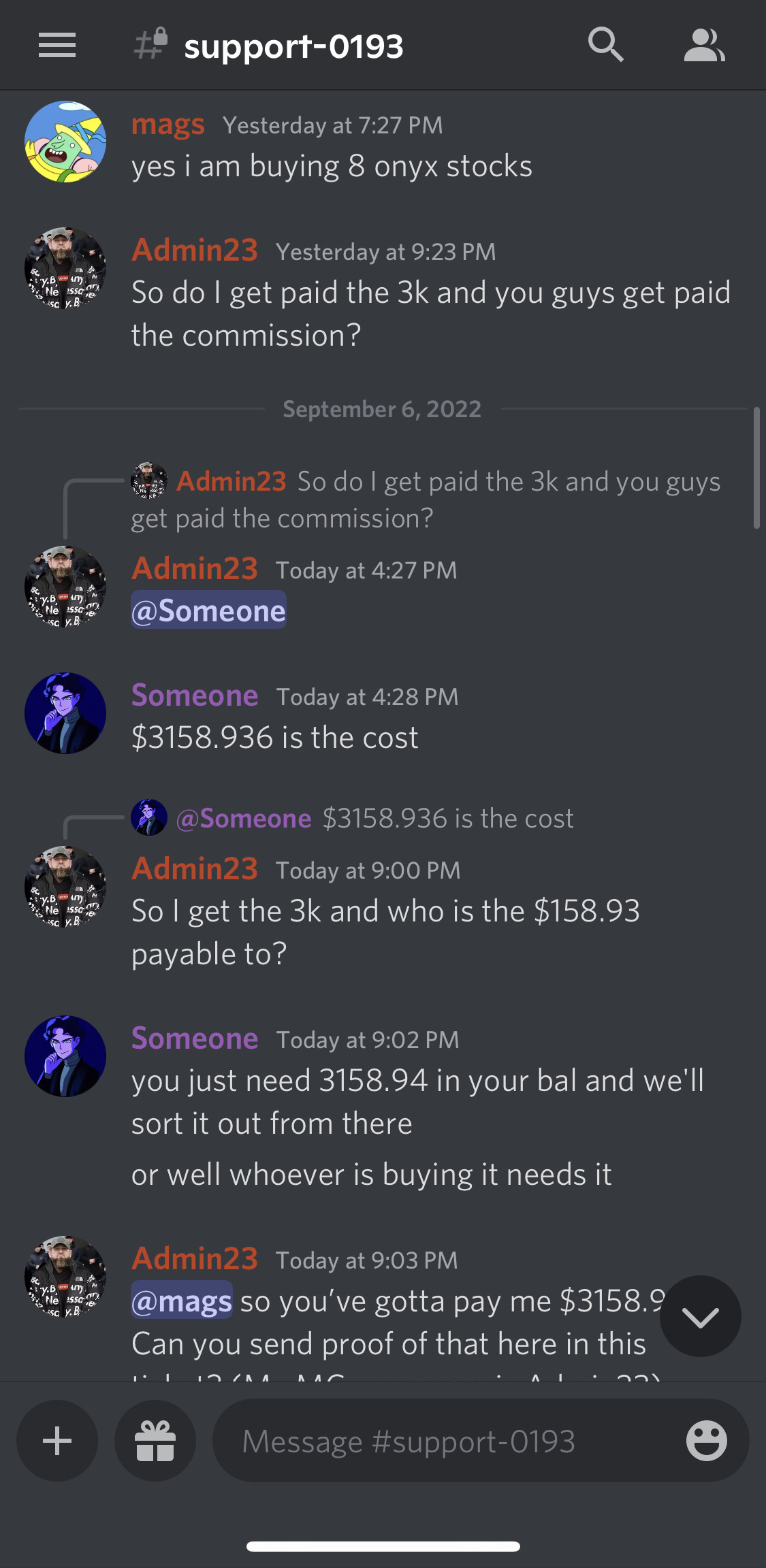

1. On September 6th, a private trader, magsymags, DMed the Plaintiff, Admin23, about purchasing Onyx Industries stocks at a price that would be agreeable to the buyer and seller (the very definition of supply and demand). The Plaintiff, Admin23, responded that the price is $3,000 for the 8 stocks.

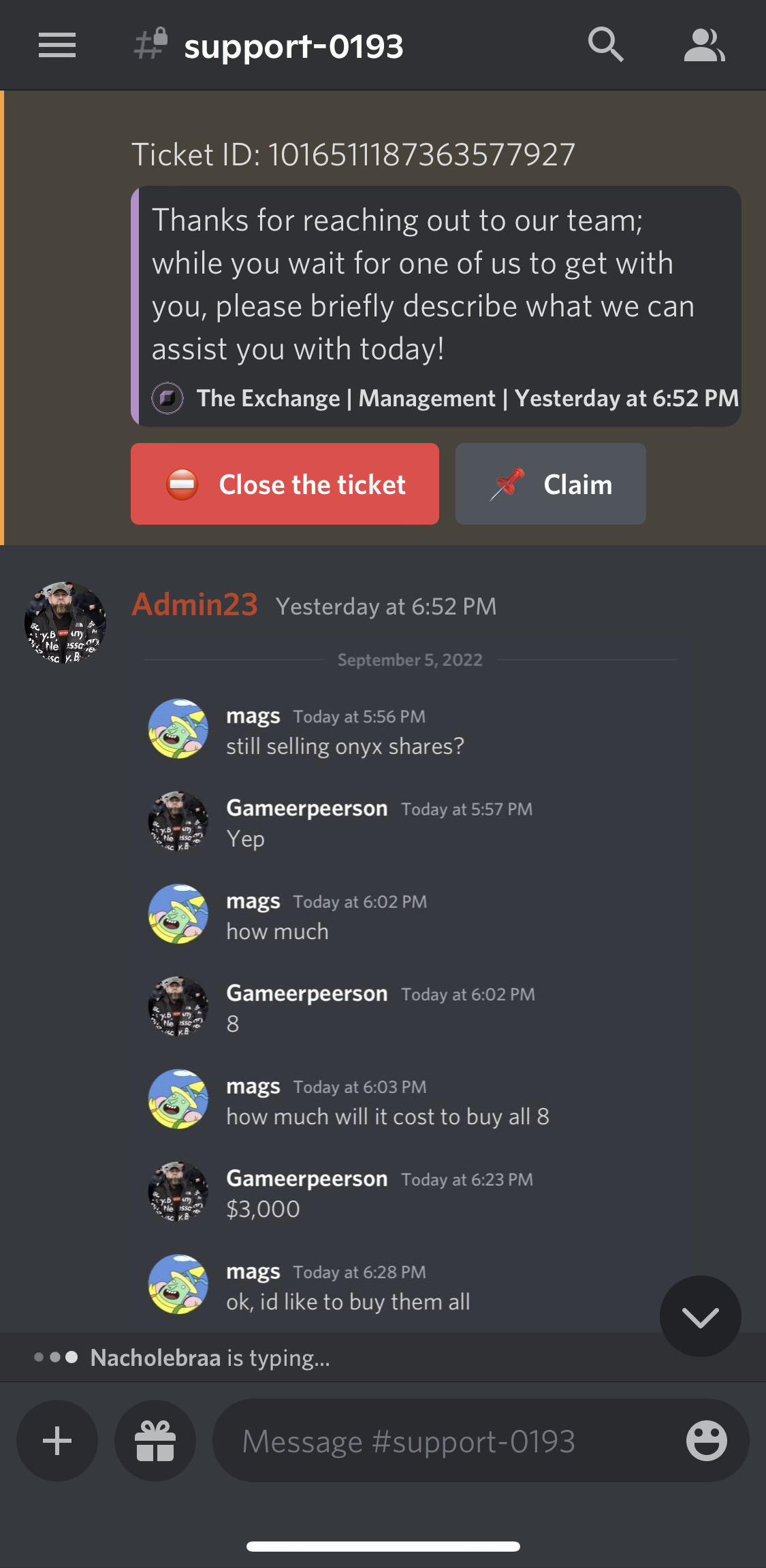

2. On the same day, the Plaintiff opened a ticket in the Exchange Discord showing the conversation between magsymags and the Plaintiff.

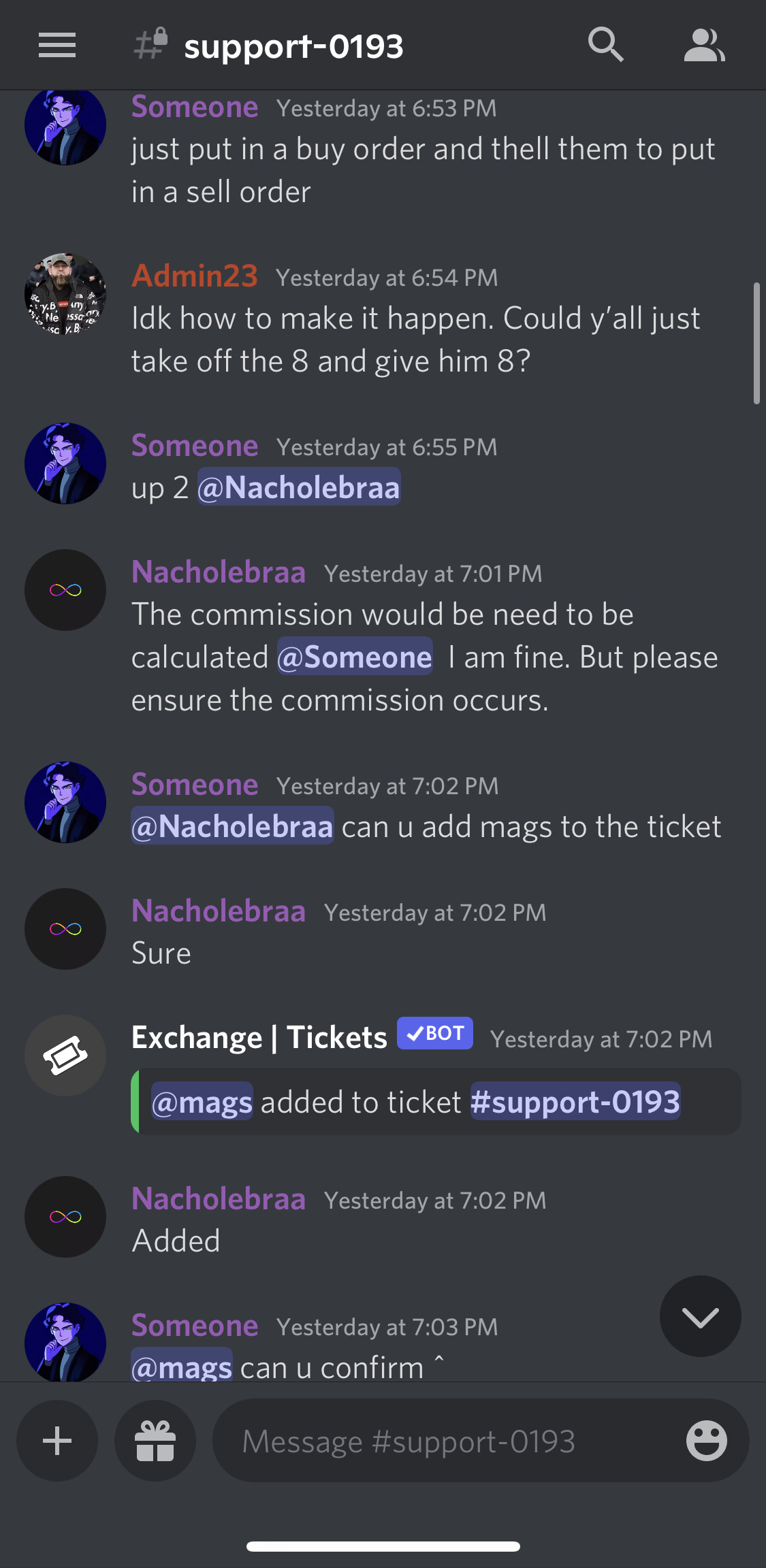

3. Aezal (Discord name being “Someone”) stated that the price (including commission) for the stocks would be $3,158.94 and had no problem with the transaction.

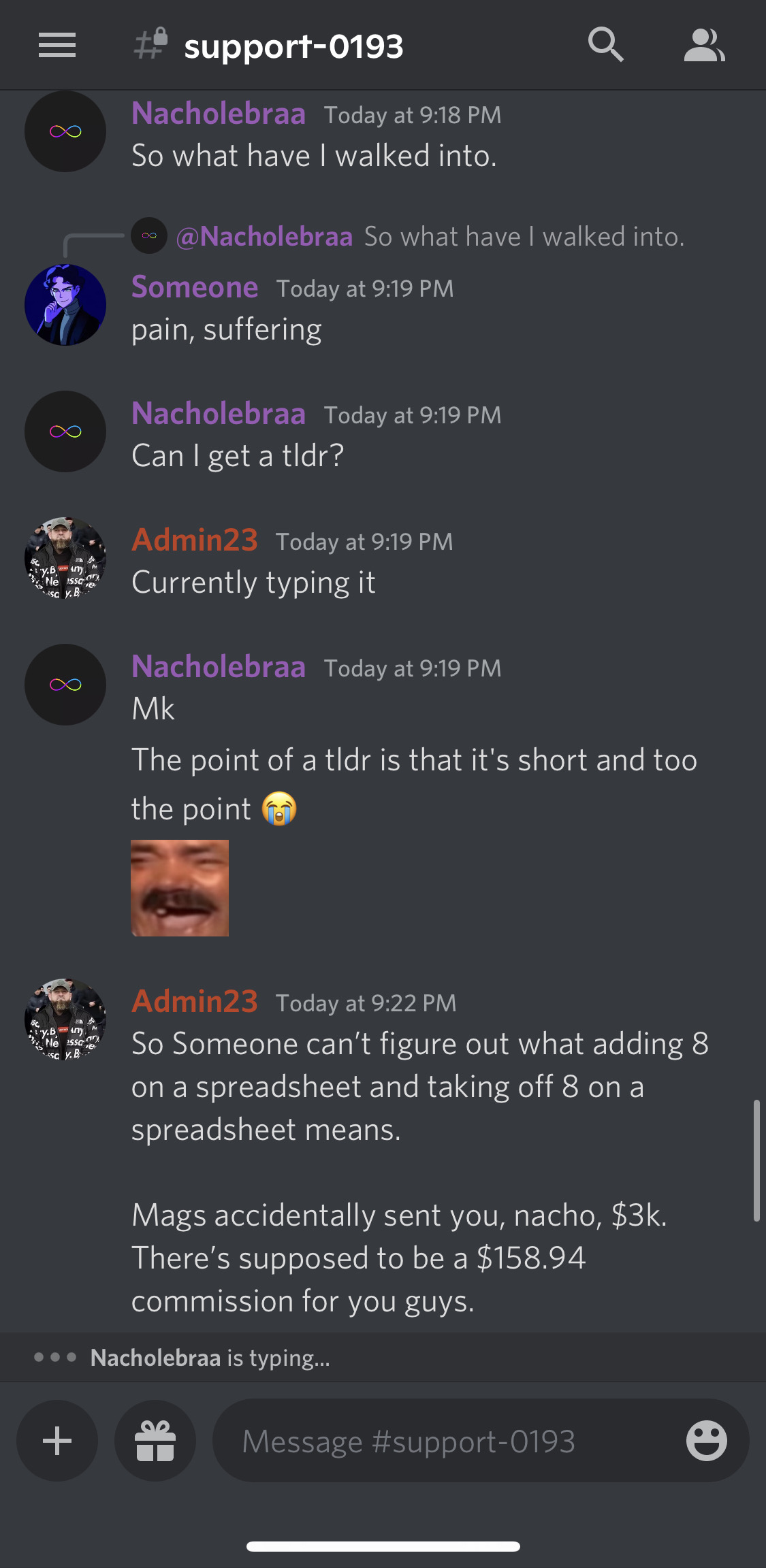

4. magsymags sent $3,000 to Nacholebraa the day prior, September 5th. This money was deposited into an account with the Exchange. An account with the Exchange has the sole purpose of processing transactions with the Exchange.

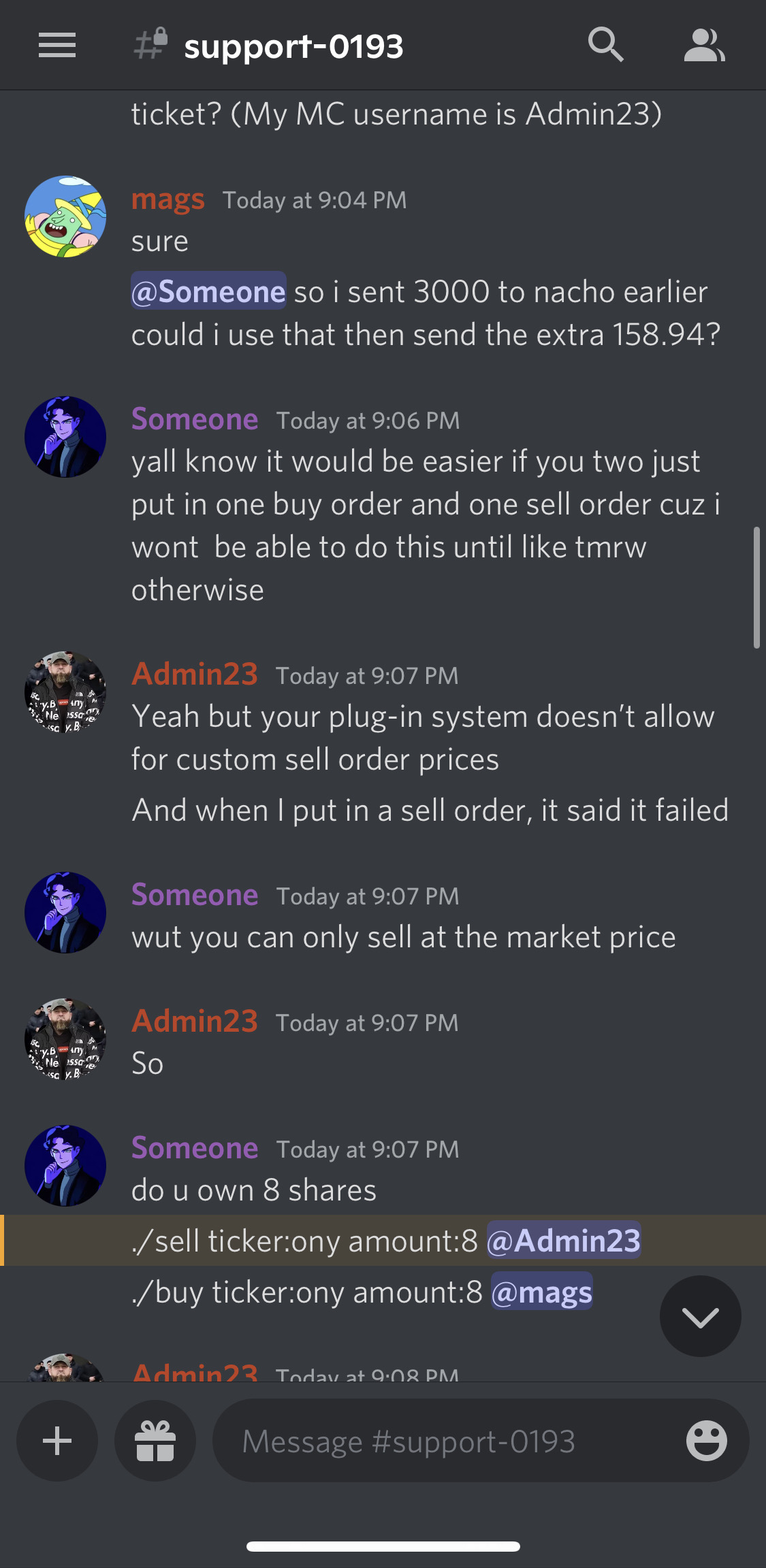

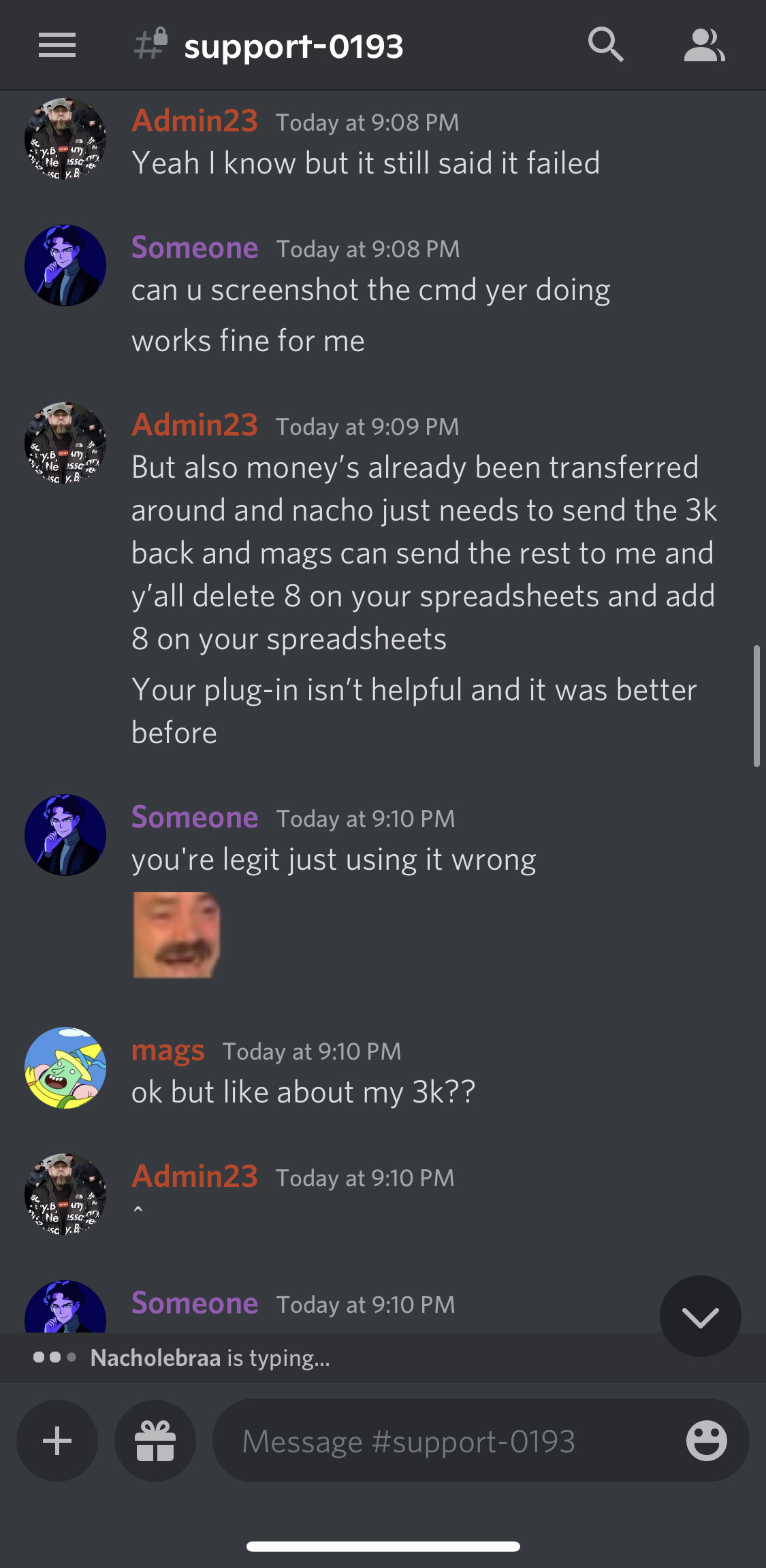

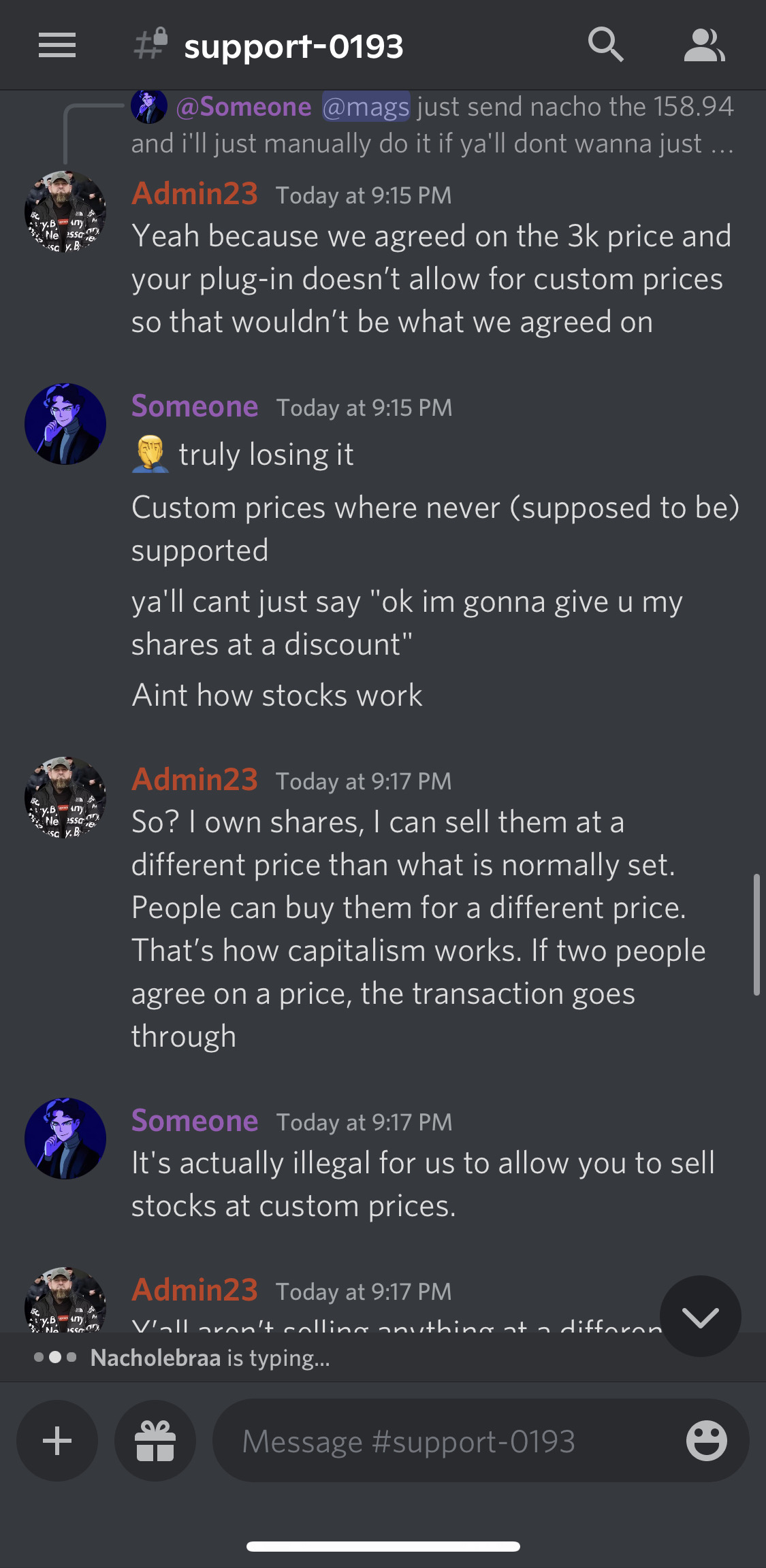

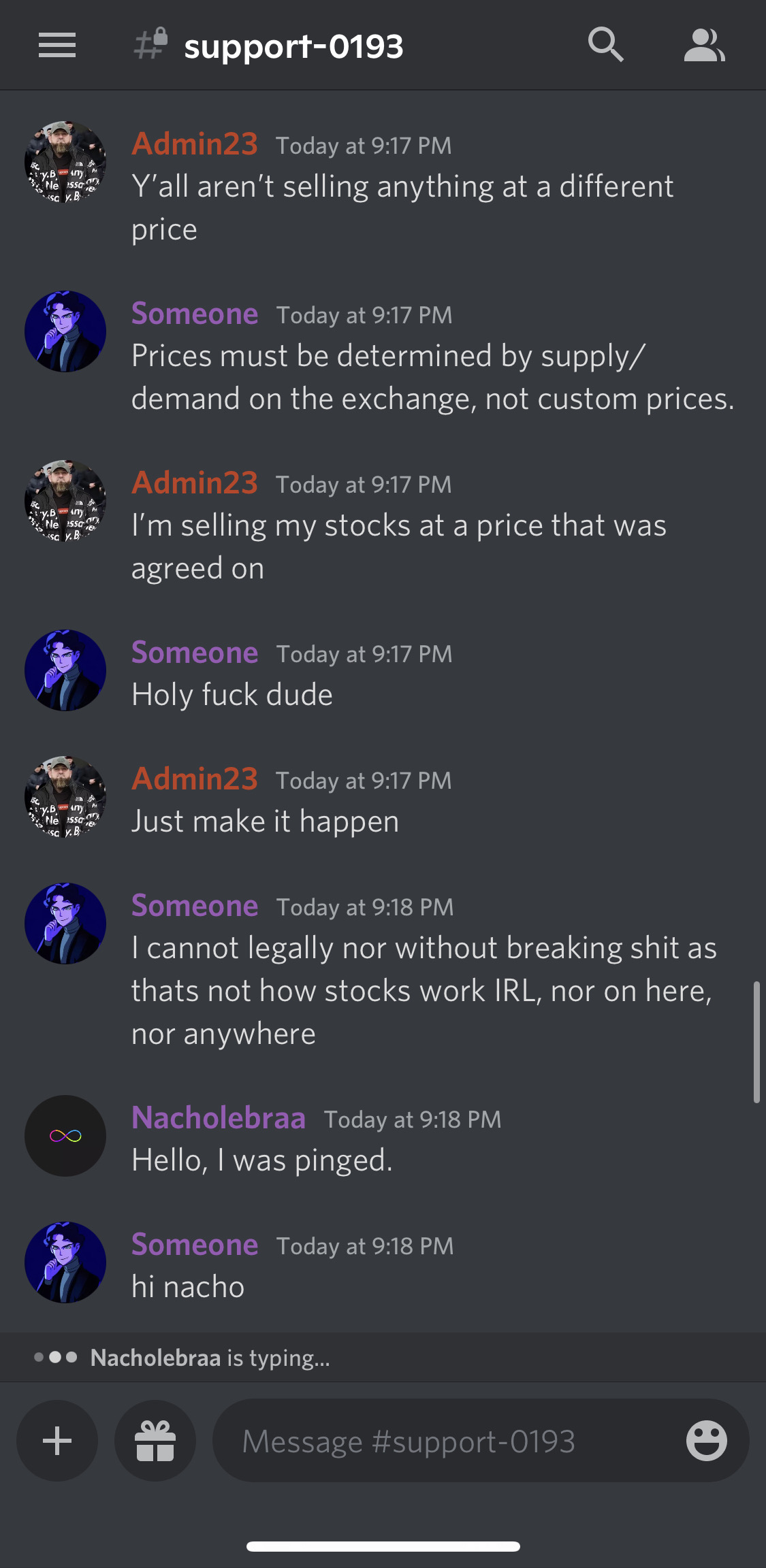

5. Aezal continually belittled, facepalmed, cussed at, and laughed at the Plaintiff for “legit just using [the bot] wrong” when the Plaintiff did not want to use the bot because it did not allow for supply and demand to dictate the price of stocks.

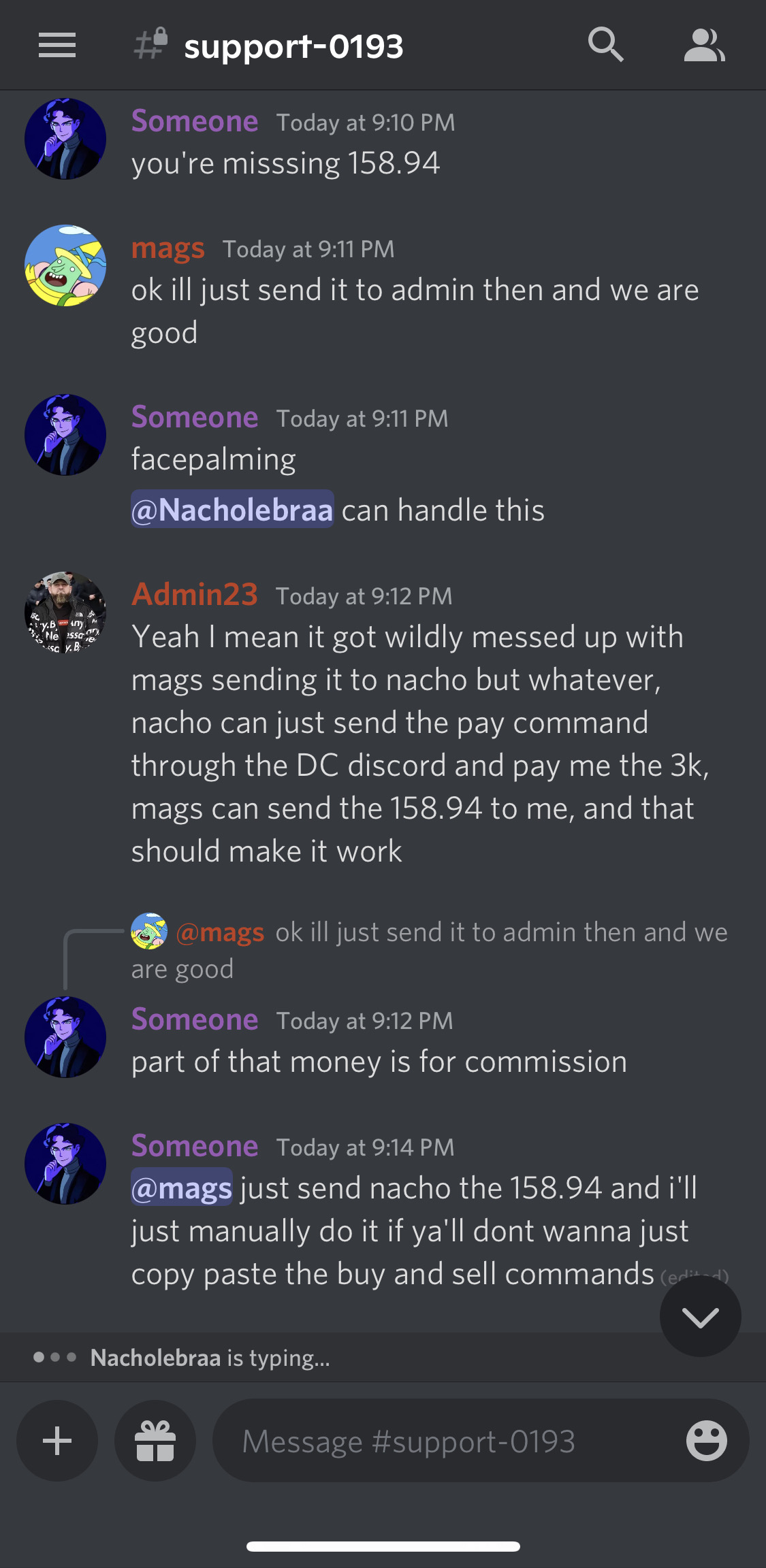

6. Aezal states that he will “just manually do it”, meaning he will just manually edit the numbers. This shows that it is a possibility to edit the numbers of stocks an individual owns without requiring the bot to do it, meaning what the Plaintiff wanted to do was entirely possible. This means that the Terms of Service was edited at this very moment because of an agreement between Aezal, magsymags, and the Plaintiff. magsymags upheld his end of the bargain by providing $3,000 to Nacholebraa the day prior. This amount was in magsymags’ Exchange account. An account with the Exchange has the sole purpose of having ready funds to process transactions. The Exchange refused to accept that this amount was usable and demanded another $3,000 to process the transaction. Demanding another $3,000 to process a transaction when $3,000 was already deposited into magsymags’ Exchange account is tantamount to theft. There was no reason to demand another $3,000 when that amount of money was already in his account. As the Defendant has stated in their motion to dismiss in the previous court case that:

“The Exchange (TE) is a privately owned and operated securities exchange. TE states within its terms and services (TOS) that services can be canceled at any time with or without notice.”

The Exchange is well within its rights to change the terms at any time and that is perfectly fine. However, what the Exchange cannot do is vary the Terms of Service via an agreement and then steal $3,000, and then vary the terms again to cover up stealing the $3,000 (by closing the ticket and cancelling the service agreed to by Aezal).

7. Aezal states:

“Custom prices where never (supposed to be) supported. Ya’ll cant just say ‘ok im gonna give u my shares at a discount.’ Aint how stocks work.”

The Plaintiff replies that they are his stocks that he can sell at his own price and there is nothing wrong with that and says: “If two people agree on a price, the transaction goes through.”

The Plaintiff’s position is proven correct with a quick reading of the the Corporate Law and Shareholder Protection Act 4(3). If a buyer and seller agree on a price, that is a price dictated by supply and demand and must be allowed. Any deviation from that is illegal.

8. Aezal then explains that it is illegal for the Exchange to sell stocks at a custom price by saying:

“It’s actually illegal for us to allow you to sell stocks at a custom price.”

This is an odd statement given the willingness of Aezal to do so in paragraph 6 above. This is a direct contradiction of a previous statement, so either Aezal was willing to violate the law very readily previously, or this statement is a lie, and would constitute fraud, as defined under the Crackdown on White-Collar Crime Act as:

”an intentional or reckless misrepresentation or omission of an important fact, especially a material one, to a victim who justifiably relies on that misrepresentation; and the victim party or entity suffered actual, quantifiable injury or damages as a result of the misrepresentation or omission.”

That quantifiable injury inflicted upon the Plaintiff being the lack of a sale of 8 Onyx Industries stocks for $3,000.

9. The Plaintiff pushes to get the manual transfer of stocks over to magsymags as Aezal previously explicitly stated that it was possible. Aezal then cusses at the Plaintiff and for no reason.

10. After the explanation of the situation by the Plaintiff to Nacholebraa, Aezal states that the total price of the 8 Onyx Industries stocks is $2,871.78 and that the commission is $287.17. That commission is 10% of the total sale price of stocks. $158.94 is most definitely not 10% of the stock price of $3,000. This shows a wild discrepancy and inconsistency between commission amounts. This 10% commission is confirmed in another conversation between Aladeen and Aezal. Aezal lied to the Plaintiff about the amount of commission that should be paid. The Plaintiff disagreed with the price of the stocks as that price ($2,871.78) was not agreed upon by magsymags and the Plaintiff.

11. Nacholebraa states:

“In accordance with the CLA The Exchange is able to support a customer made price for the stocks as it would be in violation of Federal Law and we do not do that sort of thing around here. … I attached the screenshot of the act of congress in specific that references our inability to make custom prices.”

It seems that the Exchange does indeed “do that sort of thing around here.”

Nacholebraa’s statement makes no sense as he says:

“The Exchange is able to support a customer made price for the stocks…” but then states that would violate federal law.

The law that “does not allow the Exchange to create a custom price” is the Corporate Law and Shareholder Protections Act. Specifically, Paragraph 4(3), which states:

“(3) Securities Exchanges will be prohibited from calculating the market prices of shares in Public Companies using any factors other than the market supply of and demand for said shares. They will be responsible for updating these prices without requiring further input from the companies of which the shares grant ownership in.

(a) Securities Exchanges must provide consistent updates to the market prices of company shares. Each company listed on an exchange must have its stock price updated at least once every 30 days.

(b) Legal entities holding more than 20% of the stock in any public company must report their holdings to the Department of Education and Commerce.”

Nowhere does it say that the Exchange cannot transfer stocks from one person to another with both party’s approval. It does not say that two individuals cannot create a price that is agreeable to both of them for a stock and then have the Exchange transfer it by showing consent from both parties. The law simply states that the Exchange may not create a price for a stock that is anything other than what is dictated by supply and demand. However this also has been violated. The Discord bot that the Exchange employs uses a price for stocks that is dictated by the Exchange, not the market. This is a violation of the Corporate Law and Shareholder Protections Act.

12. Nacholebraa states that it was the Plaintiff who was being disrespectful to Aezal when the Plaintiff was reacting to Aezal’s demeaning behavior. This was Nacholebraa’s basis to arbitrarily close down a ticket requesting a perfectly legal sale of stocks and forced the sale to be done through the bot which is not what either magsymags or the Plaintiff had wanted.

13. The Exchange uses a Discord bot that uses arbitrary prices for stocks and does not allow for deviation in the price to match what people are actually willing to buy or sell for. This means that the Exchange does not use supply and demand to determine the price of stocks. The Exchange dictates the price of stocks to people.

14. By closing the ticket and editing the Terms of Service again, the Exchange forced the Plaintiff and magsymags to use the Discord bot that forces arbitrary and illegal prices on customers.

III. CLAIMS FOR RELIEF

1. The Exchange has violated the law that they have stated on multiple occasions they are attempting to abide by — the Corporate Law and Shareholder Protections Act. The applicable part of this law being:

“Securities Exchanges will be prohibited from calculating the market prices of shares in Public Companies using any factors other than the market supply of and demand for said shares. They will be responsible for updating these prices without requiring further input from the companies of which the shares grant ownership in.”

The Exchange has refused to process the transaction between the Plaintiff and magsymags and forced both the Plaintiff and magsymags to use the Discord bot. This bot forces people to use an arbitrary price. This price is not variable. That means that people cannot buy and sell things at a price that the market deems fair. If a buyer (demand) and a seller (supply) agree on a price, that is what the market deems fair and that transaction must be processed as deemed by the law quoted above. The Exchange refused to do this.

2. The Exchange lying to the Plaintiff three times.

First was that it was illegal for the sale with custom prices to be facilitated.

Second was that the commission was $158.94 and not $300 (10% of $3,000), which was later changed to 10% (287.17) when the total price of stocks were lowered by Aezal from the agreed upon $3,000 down to $2871.76.

Third was the reiteration of the fact that the Exchange supposedly cannot facilitate the transfer of stocks at a custom price agreed to by two parties because it is illegal.

2. The forcing a transfer of stocks by the Exchange at a different price than was determined by supply and demand. It was already explicitly stated that the transfer was possible by Aezal before he deemed that it was illegal, when, in fact, it was and is most definitely not illegal.

3. The insults and belittlement by the Exchange.

4. The three previous claims caused the Plaintiff to lose out on a deal that was already agreed upon.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $30,000 in punitive damages from the Exchange (or Nacholebraa as he is the owner of the Exchange)

2. A public and sincere apology from the Exchange to all customers of the Exchange for breaking the law and damaging its customers.

Exhibit 1

Exhibit 2

Exhibit 3

Exhibit 4

Exhibit 5

Exhibit 6

Exhibit 7

Exhibit 8

Exhibit 9

Exhibit 10

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 22nd day of September 2022

CIVIL ACTION

Admin23

Plaintiff

v.

The Exchange

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

WRITTEN STATEMENT FROM THE PLAINTIFF

First, the Exchange has blatantly disregarded the Corporate Law and Shareholder Protections Act while supposedly doing their utmost job to uphold it. The Exchange has forced its customers to use a Discord bot that does not allow for custom prices and makes its own price based on something that is most definitely not supply and demand. Second, the Exchange has committed fraud twice by stating that it is illegal to allow for supply and demand to dictate prices (supply being the seller and demand being the buyer) and harmed the Plaintiff, Admin23, by doing so. Third, the Exchange has added insult to injury, quite literally and insulted and belittled the Plaintiff while violating the law.

I. PARTIES

1. Admin23 - Plaintiff

2. Someone (username in DC Discord is Aezal) - Employee of the Defendant

3. Nacholebraa - Owner of, and responsible party for, the Defendant

4. The Exchange - Defendant

II. FACTS

1. On September 6th, a private trader, magsymags, DMed the Plaintiff, Admin23, about purchasing Onyx Industries stocks at a price that would be agreeable to the buyer and seller (the very definition of supply and demand). The Plaintiff, Admin23, responded that the price is $3,000 for the 8 stocks.

2. On the same day, the Plaintiff opened a ticket in the Exchange Discord showing the conversation between magsymags and the Plaintiff.

3. Aezal (Discord name being “Someone”) stated that the price (including commission) for the stocks would be $3,158.94 and had no problem with the transaction.

4. magsymags sent $3,000 to Nacholebraa the day prior, September 5th. This money was deposited into an account with the Exchange. An account with the Exchange has the sole purpose of processing transactions with the Exchange.

5. Aezal continually belittled, facepalmed, cussed at, and laughed at the Plaintiff for “legit just using [the bot] wrong” when the Plaintiff did not want to use the bot because it did not allow for supply and demand to dictate the price of stocks.

6. Aezal states that he will “just manually do it”, meaning he will just manually edit the numbers. This shows that it is a possibility to edit the numbers of stocks an individual owns without requiring the bot to do it, meaning what the Plaintiff wanted to do was entirely possible. This means that the Terms of Service was edited at this very moment because of an agreement between Aezal, magsymags, and the Plaintiff. magsymags upheld his end of the bargain by providing $3,000 to Nacholebraa the day prior. This amount was in magsymags’ Exchange account. An account with the Exchange has the sole purpose of having ready funds to process transactions. The Exchange refused to accept that this amount was usable and demanded another $3,000 to process the transaction. Demanding another $3,000 to process a transaction when $3,000 was already deposited into magsymags’ Exchange account is tantamount to theft. There was no reason to demand another $3,000 when that amount of money was already in his account. As the Defendant has stated in their motion to dismiss in the previous court case that:

“The Exchange (TE) is a privately owned and operated securities exchange. TE states within its terms and services (TOS) that services can be canceled at any time with or without notice.”

The Exchange is well within its rights to change the terms at any time and that is perfectly fine. However, what the Exchange cannot do is vary the Terms of Service via an agreement and then steal $3,000, and then vary the terms again to cover up stealing the $3,000 (by closing the ticket and cancelling the service agreed to by Aezal).

7. Aezal states:

“Custom prices where never (supposed to be) supported. Ya’ll cant just say ‘ok im gonna give u my shares at a discount.’ Aint how stocks work.”

The Plaintiff replies that they are his stocks that he can sell at his own price and there is nothing wrong with that and says: “If two people agree on a price, the transaction goes through.”

The Plaintiff’s position is proven correct with a quick reading of the the Corporate Law and Shareholder Protection Act 4(3). If a buyer and seller agree on a price, that is a price dictated by supply and demand and must be allowed. Any deviation from that is illegal.

8. Aezal then explains that it is illegal for the Exchange to sell stocks at a custom price by saying:

“It’s actually illegal for us to allow you to sell stocks at a custom price.”

This is an odd statement given the willingness of Aezal to do so in paragraph 6 above. This is a direct contradiction of a previous statement, so either Aezal was willing to violate the law very readily previously, or this statement is a lie, and would constitute fraud, as defined under the Crackdown on White-Collar Crime Act as:

”an intentional or reckless misrepresentation or omission of an important fact, especially a material one, to a victim who justifiably relies on that misrepresentation; and the victim party or entity suffered actual, quantifiable injury or damages as a result of the misrepresentation or omission.”

That quantifiable injury inflicted upon the Plaintiff being the lack of a sale of 8 Onyx Industries stocks for $3,000.

9. The Plaintiff pushes to get the manual transfer of stocks over to magsymags as Aezal previously explicitly stated that it was possible. Aezal then cusses at the Plaintiff and for no reason.

10. After the explanation of the situation by the Plaintiff to Nacholebraa, Aezal states that the total price of the 8 Onyx Industries stocks is $2,871.78 and that the commission is $287.17. That commission is 10% of the total sale price of stocks. $158.94 is most definitely not 10% of the stock price of $3,000. This shows a wild discrepancy and inconsistency between commission amounts. This 10% commission is confirmed in another conversation between Aladeen and Aezal. Aezal lied to the Plaintiff about the amount of commission that should be paid. The Plaintiff disagreed with the price of the stocks as that price ($2,871.78) was not agreed upon by magsymags and the Plaintiff.

11. Nacholebraa states:

“In accordance with the CLA The Exchange is able to support a customer made price for the stocks as it would be in violation of Federal Law and we do not do that sort of thing around here. … I attached the screenshot of the act of congress in specific that references our inability to make custom prices.”

It seems that the Exchange does indeed “do that sort of thing around here.”

Nacholebraa’s statement makes no sense as he says:

“The Exchange is able to support a customer made price for the stocks…” but then states that would violate federal law.

The law that “does not allow the Exchange to create a custom price” is the Corporate Law and Shareholder Protections Act. Specifically, Paragraph 4(3), which states:

“(3) Securities Exchanges will be prohibited from calculating the market prices of shares in Public Companies using any factors other than the market supply of and demand for said shares. They will be responsible for updating these prices without requiring further input from the companies of which the shares grant ownership in.

(a) Securities Exchanges must provide consistent updates to the market prices of company shares. Each company listed on an exchange must have its stock price updated at least once every 30 days.

(b) Legal entities holding more than 20% of the stock in any public company must report their holdings to the Department of Education and Commerce.”

Nowhere does it say that the Exchange cannot transfer stocks from one person to another with both party’s approval. It does not say that two individuals cannot create a price that is agreeable to both of them for a stock and then have the Exchange transfer it by showing consent from both parties. The law simply states that the Exchange may not create a price for a stock that is anything other than what is dictated by supply and demand. However this also has been violated. The Discord bot that the Exchange employs uses a price for stocks that is dictated by the Exchange, not the market. This is a violation of the Corporate Law and Shareholder Protections Act.

12. Nacholebraa states that it was the Plaintiff who was being disrespectful to Aezal when the Plaintiff was reacting to Aezal’s demeaning behavior. This was Nacholebraa’s basis to arbitrarily close down a ticket requesting a perfectly legal sale of stocks and forced the sale to be done through the bot which is not what either magsymags or the Plaintiff had wanted.

13. The Exchange uses a Discord bot that uses arbitrary prices for stocks and does not allow for deviation in the price to match what people are actually willing to buy or sell for. This means that the Exchange does not use supply and demand to determine the price of stocks. The Exchange dictates the price of stocks to people.

14. By closing the ticket and editing the Terms of Service again, the Exchange forced the Plaintiff and magsymags to use the Discord bot that forces arbitrary and illegal prices on customers.

III. CLAIMS FOR RELIEF

1. The Exchange has violated the law that they have stated on multiple occasions they are attempting to abide by — the Corporate Law and Shareholder Protections Act. The applicable part of this law being:

“Securities Exchanges will be prohibited from calculating the market prices of shares in Public Companies using any factors other than the market supply of and demand for said shares. They will be responsible for updating these prices without requiring further input from the companies of which the shares grant ownership in.”

The Exchange has refused to process the transaction between the Plaintiff and magsymags and forced both the Plaintiff and magsymags to use the Discord bot. This bot forces people to use an arbitrary price. This price is not variable. That means that people cannot buy and sell things at a price that the market deems fair. If a buyer (demand) and a seller (supply) agree on a price, that is what the market deems fair and that transaction must be processed as deemed by the law quoted above. The Exchange refused to do this.

2. The Exchange lying to the Plaintiff three times.

First was that it was illegal for the sale with custom prices to be facilitated.

Second was that the commission was $158.94 and not $300 (10% of $3,000), which was later changed to 10% (287.17) when the total price of stocks were lowered by Aezal from the agreed upon $3,000 down to $2871.76.

Third was the reiteration of the fact that the Exchange supposedly cannot facilitate the transfer of stocks at a custom price agreed to by two parties because it is illegal.

2. The forcing a transfer of stocks by the Exchange at a different price than was determined by supply and demand. It was already explicitly stated that the transfer was possible by Aezal before he deemed that it was illegal, when, in fact, it was and is most definitely not illegal.

3. The insults and belittlement by the Exchange.

4. The three previous claims caused the Plaintiff to lose out on a deal that was already agreed upon.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $30,000 in punitive damages from the Exchange (or Nacholebraa as he is the owner of the Exchange)

2. A public and sincere apology from the Exchange to all customers of the Exchange for breaking the law and damaging its customers.

Exhibit 1

Exhibit 2

Exhibit 3

Exhibit 4

Exhibit 5

Exhibit 6

Exhibit 7

Exhibit 8

Exhibit 9

Exhibit 10

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 22nd day of September 2022

Last edited: