dodrio3

Citizen

Supporter

Aventura Resident

Grave Digger

Change Maker

Popular in the Polls

Statesman

Dodrio3

Attorney

- Joined

- May 15, 2021

- Messages

- 302

- Thread Author

- #1

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Titan Law

Plaintiff

v.

The Commonwealth of Redmont

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

WRITTEN STATEMENT FROM THE PLAINTIFF

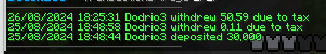

Beginning on August 25, 2024, Titan Law initiated an analysis of the taxation system employed by the Commonwealth of Redmont. Through this analysis, Titan Law determined that the government had been levying taxes at an excessive rate of 1.2% (rounded to two significant figures) (P-002) on a balance of $30,000. This rate exceeds the 1% tax rate stipulated by the Taxation Act for such a balance, thereby placing the Commonwealth of Redmont in clear violation of the Taxation Law.

I. PARTIES

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

(Attach evidence and a list of witnesses at the bottom if applicable)

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This (day) day of (month) (year)

P-01

P-02

Taxation Maths

CIVIL ACTION

Titan Law

Plaintiff

v.

The Commonwealth of Redmont

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

WRITTEN STATEMENT FROM THE PLAINTIFF

Beginning on August 25, 2024, Titan Law initiated an analysis of the taxation system employed by the Commonwealth of Redmont. Through this analysis, Titan Law determined that the government had been levying taxes at an excessive rate of 1.2% (rounded to two significant figures) (P-002) on a balance of $30,000. This rate exceeds the 1% tax rate stipulated by the Taxation Act for such a balance, thereby placing the Commonwealth of Redmont in clear violation of the Taxation Law.

I. PARTIES

- Titan Law

- Commonwealth of Redmont

- The Commonwealth of Redmont has been systematically overtaxing its citizens. Titan Law conducted an analysis (P-01) which demonstrates that a tax rate of 1.2% (rounded to two significant figures) (P-002) was erroneously applied to Titan Law's business account on a weekly basis.

- According to the Taxation Act, a weekly tax rate of 1% should be applied to "Corporate and Personal Balances." However, the tax applied was approximately 0.2% higher than the legally mandated rate.

- The Commonwealth of Redmont is in direct breach of the Taxation Act by imposing a tax rate that exceeds the lawful limit.

- The Commonwealth of Redmont has unlawfully overtaxed its citizens by collecting more funds than is legally permissible.

- This egregious action by the Commonwealth, whether intentional or unintentional, could have significant adverse effects on the financial well-being of Redmont’s citizens and businesses, diminishing personal savings and depleting business reserves.

- If the issue with the taxation is determined to stem from staff errors, this reflects gross negligence on the part of the Department of Commerce (DOC) for failing to address such a critical issue when it was initially brought to their attention. The DOC's lack of action has directly contributed to the prolonged over taxation of Redmont’s citizens and businesses, exacerbating the financial harm caused. Witnesses to this negligence will be presented during the discovery phase to substantiate these claims.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

- The Commonwealth of Redmont should be compelled to return all funds that have been unlawfully overtaxed to the citizens of Redmont. The Department of Commerce (DOC) should oversee this process, under the supervision of a House oversight committee, to ensure compliance and accuracy.

- The Commonwealth of Redmont should be required to pay $15,000 in punitive damages to each individual who has been subjected to incorrect taxation, as a consequence of the egregious overtaxing of its citizens.

- Titan Law should be awarded 30% of the total value of the final determined amount in legal fees, as compensation for legal representation and associated costs.

(Attach evidence and a list of witnesses at the bottom if applicable)

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This (day) day of (month) (year)

P-01

P-02

Taxation Maths